Table of Content

You’ve opened all your gifts, and now it’s time to open those post-holiday credit card statements. If you were a little too jolly with your holiday spending, here are some tips to help you pay down your credit card debt. When you use your credit card to buy something, you... Predatory or unscrupulous lenders may try to charge you improper fees, like late fees that aren’t mentioned in your contract or that are much higher than other lenders’.

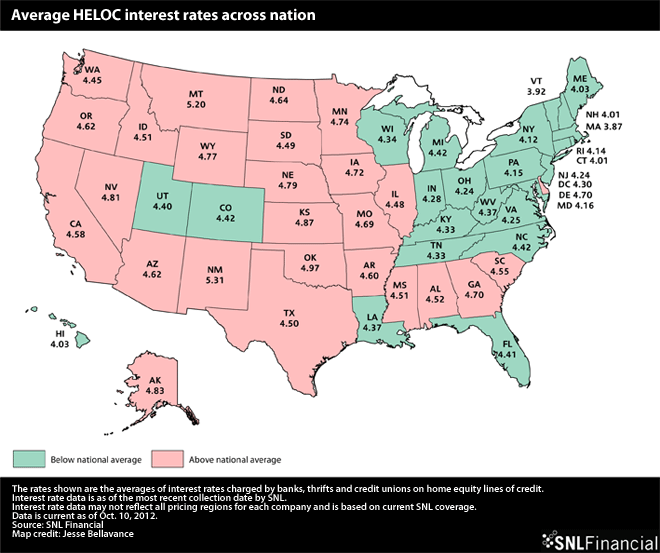

Information like your bill-paying history, the number and type of accounts you have, late payments, collection actions, outstanding debt, and how long you've had your accounts helps predict how likely it is that you’ll repay the loan — and on time. While HELOCs are essentially a revolving line of credit, home equity loans provide the borrower with a single lump sum up front. Most home equity loans charge a fixed rate of interest and must be repaid according to a preset schedule. Borrowers will immediately begin paying interest on the entire amount of the loan, unlike with HELOCs, where borrowers only pay interest on the amount that they have actually borrowed. HELOCs also generally charge lower interest rates than home equity loans. As of the first quarter of 2019, the average annual percentage rate on home equity loans was about 8.75%.

- Consumer Financial Protection Bureau

The terms of a high-cost mortgage agreement may provide that any payment shall first be applied to any past due balance. If the consumer fails to make a timely payment by the due date and subsequently resumes making payments but has not paid all past due payments, the creditor may impose a separate late payment charge for any payment outstanding until the default is cured. State law requirements are inconsistent with the requirements contained in sections 161 or 162 of the Act and the implementing provisions of this part and are preempted if they provide rights, responsibilities, or procedures for consumers or creditors that are different from those required by the Federal law. If the state disclosures are made on the same side of a page as the required Federal disclosures, the state disclosures shall appear under a demarcation line below the Federal disclosures, and the Federal disclosures shall be identified by a heading indicating that they are made in compliance with Federal law. In an oral response to a consumer's inquiry about the cost of open-end credit, only the annual percentage rate or rates shall be stated, except that the periodic rate or rates also may be stated.

The HELOC market shrank to a fraction of the 2005 high in the wake of the Subprime Mortgage Meltdown but has risen steadily ever since. Home equity lines of credit are, as their name says, simply lines of credit that are secured by a portion of the equity that you have accumulated in your home. In most cases, you can borrow up to 85% of the value of your home minus the amount of your primary mortgage.

Interagency Guidance on Home Equity Lines of Credit (HELOCs) Nearing Their End-of-Draw Period

Interest, dividends, or other income received or to be received by the consumer on deposits or investments shall not be deducted in computing the finance charge. The premium for insurance in lieu of perfecting a security interest to the extent that the premium does not exceed the fees described in paragraph of this section that otherwise would be payable. Taxes and fees prescribed by law that actually are or will be paid to public officials for determining the existence of or for perfecting, releasing, or satisfying a security interest.

Card issuer means a person that issues a credit card or that person's agent with respect to the card. In such regard, taking a home equity loan means putting your home on the line, and a decrease in real estate value can attract more debt than the market worth of the property. If you intend to relocate, the loss on the property’s sale may suffice, or even become immovable. The availability of the alternatives above significantly influences the home equity credit market. Since homeowners often pay off other debts, refinancing is likely to occur in large volumes when interest rates fall. These types of loan come with risks.

What Laws Regulate Home Equity Lenders?

Appraisals required--In general. Except as provided in paragraph of this section, a creditor shall not extend a higher- priced mortgage loan to a consumer without obtaining, prior to consummation, a written appraisal of the property to be mortgaged. The appraisal must be performed by a certified or licensed appraiser who conducts a physical visit of the interior of the property that will secure the transaction. For an open-end credit plan,prepayment penalty means a charge imposed by the creditor if the consumer terminates the open-end credit plan prior to the end of its term, other than a waived, bona fide third-party charge that the creditor imposes if the consumer terminates the open-end credit plan sooner than 36 months after account opening.

A home equity line of credit is classified as a line of credit that is determined by the current state of an individual’s home equity, which is defined as the difference between the amount of money outstanding with regard to a home loan and the amount of money at which the home is valued. A home equity line of creditis allowed to homeowner borrowers with regard to the amount of home equity in their respective possession. An interest rate that changes periodically in relation to an index. Payments may increase or decrease accordingly. The periodic charge, expressed as a percentage, for use of credit.

The Difference Between HELOCs and Home Equity Loans

If you are just going to run your credit cards back up by buying luxury goods and perishable items such as expensive meals, then you can quickly find yourself upside down on a monthly basis, as you won’t be able to make your HELOC payment on top of your other credit card payments. Effective HELOC portfolio management includes analyzing the portfolio by segment using criteria such as product type, credit risk score, loan-to-value ratio, debt-to-income ratio, property type, geographic area, and lien position. In addition, you are encouraged to perform stress tests or sensitivity analyses on your HELOC portfolios.

In describing how the applicable rate will be determined, the card issuer must identify the type of index or formula that is used in setting the rate. The value of the index and the amount of the margin that are used to calculate the variable rate shall not be disclosed in the table. A disclosure of any applicable limitations on rate increases shall not be included in the table. Deferred interest or similar transactions. The disclosure provided pursuant to this paragraph must be substantially similar to Sample G--18 in Appendix G to this part. Changes provided for in agreement.

Any credit to the account during the billing cycle, including the amount and the date of crediting. The date need not be provided if a delay in crediting does not result in any finance or other charge. The date need not be provided if a delay in accounting does not result in any finance or other charge. For issuers of credit cards that are not charge cards, a reference to the Web site established by the Bureau and a statement that consumers may obtain on the Web site information about shopping for and using credit cards. Until January 1, 2013, issuers may substitute for this reference a reference to the Web site established by the Board of Governors of the Federal Reserve System.

The current balance of the consumer's pre-petition arrearage. The home equity brochure entitled "What You Should Know About Home Equity Lines of Credit" or a suitable substitute shall be provided. If a master heading, heading, subheading, label, or similar designation contains the word "estimated" or a capital letter designation in form H--25, set forth in appendix H to this part, that heading, label, or similar designation shall contain the word "estimated" and the applicable capital letter designation. For any cost that is a component of title insurance services, the introductory description "Title --" shall appear at the beginning of the label for that actual cost. On subsequent lines, in the applicable column as described in paragraph of this section, an itemization of transfer taxes, with the name of the government entity assessing the transfer tax. The number assigned to the transaction by the settlement agent for identification purposes, labeled "File #."

If you borrow $10,000, you will owe that entire sum when the plan ends. Home equity plans often set a fixed time during which you can borrow money, such as 10 years. When this period is up, the plan may allow you to renew the credit line. But in a plan that does not allow renewals, you will not be able to borrow additional money once the time has expired.

FHA. If the loan is insured by the Federal Housing Administration, the creditor shall disclose that the loan is an "FHA." If the loan is not guaranteed or insured by a Federal or State government agency, the creditor shall disclose that the loan is a "Conventional." For each type of transaction, if the originator presents to the consumer more than three loans, the originator must highlight the loans that satisfy the criteria specified in paragraph of this section. The natural person, estate, or trust provides seller financing for the sale of only one property in any 12-month period to purchasers of such property, which is owned by the natural person, estate, or trust and serves as security for the financing. The invoice may recite such prices and charges on an itemized basis or by stating an aggregate price or charge, as appropriate, for each category. Receipt no earlier than five years after consummation of a consumer's request to cancel the escrow account.

Safeguards and Protections for HELOCs

If the revised version of the disclosures required under paragraph of this section is not provided to the consumer in person, the consumer is considered to have received such version three business days after the creditor delivers or places such version in the mail. The term "step-rate mortgage" means a transaction secured by real property or a dwelling for which the interest rate will change after consummation, and the rates that will apply and the periods for which they will apply are known at consummation. The dollar amount of the increase in the loan's principal balance if the consumer makes only the minimum required payments for the maximum possible time and the earliest date on which the consumer must begin making fully amortizing payments, assuming that the maximum interest rate is reached at the earliest possible time. The sum of the amounts disclosed under paragraphs and of this section or and of this section, as applicable, labeled as "total estimated monthly payment."

No comments:

Post a Comment